🔁 Triple Net (NNN) vs. Gross Lease Explained 🧾 | What Every CRE Investor Should Know

🔁 Triple Net (NNN) vs. Gross Lease Explained 🧾 | What Every CRE Investor Should Know

🏢 NNN vs. Gross Lease 💼 | Key Differences for Commercial Property Owners & Tenants

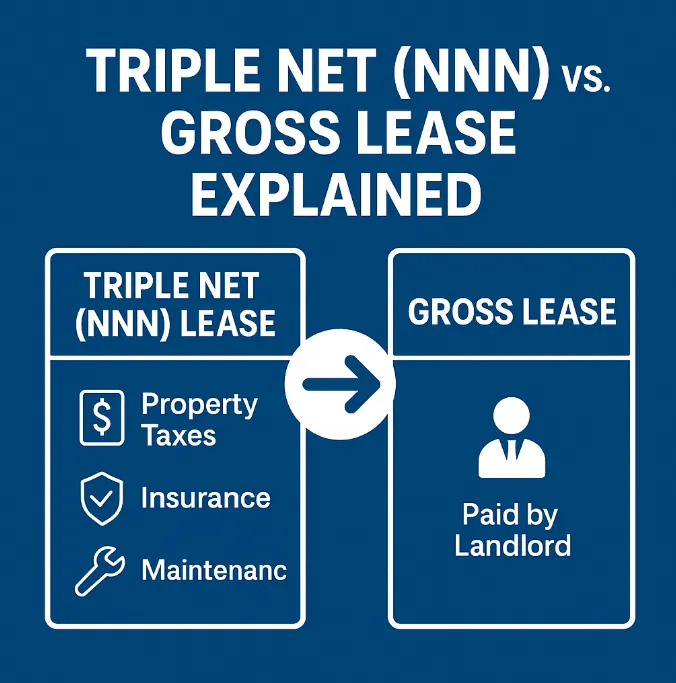

Triple Net (NNN) vs. Gross Lease Explained

When leasing commercial real estate, understanding the lease structure is critical—especially when it comes to your bottom line. Two of the most common types of leases are Triple Net (NNN) Leases and Gross Leases, each with their own pros, cons, and ideal use cases. Let’s break them down in a way that’s easy to digest and highly relevant for investors, property owners, and tenants in Houston and beyond.

🔁 What Is a Triple Net (NNN) Lease?

A Triple Net Lease is a type of lease agreement where the tenant pays:

· Property Taxes

· Insurance

· Maintenance costs

In addition to base rent. The landlord receives a predictable income stream, while the tenant assumes responsibility for operating expenses.

Best For:

✅ Long-term tenants

✅ National retail chains

✅ Passive-income investors

🧾 What Is a Gross Lease?

With a Gross Lease, the landlord pays all operating expenses, and the tenant pays a single, all-inclusive rent amount. This lease type simplifies budgeting for the tenant and places the operational burden on the landlord.

Best For:

✅ Shorter-term leases

✅ Office space

✅ Tenants seeking cost predictability

💡 Key Differences: NNN vs. Gross Lease

Feature

Triple Net (NNN) Lease

Gross Lease

Operating Expenses

Paid by tenant

Paid by landlord

Rent Predictability

Variable for tenant

Fixed for tenant

Landlord Responsibilities

Minimal

High

Ideal For

Retail/Industrial Properties

Office/Medical Properties

💬 Pros & Cons

Triple Net Lease (NNN):

👍 Pro: Passive income potential for landlords

👎 Con: Complex and potentially high costs for tenants

Gross Lease:

👍 Pro: Simple and predictable expenses for tenants

👎 Con: Landlords carry more financial risk

🤔 Which One Is Right for You?

If you're an investor looking for minimal involvement and consistent cash flow, NNN leases are often the go-to. If you're a business owner seeking stability in rent and simplicity, a gross lease may be the better fit.

Need help evaluating your lease or structuring a deal? Connect with our team at HoustonRealEstateBrokerage.com—we’re here to guide you every step of the way.

https://www.houstonrealestatebrokerage.com/

https://www.houstonrealestatebrokerage.com/houston-cre-navigator

https://www.commercialexchange.com/agent/653bf5593e3a3e1dcec275a6

http://expressoffers.com/[email protected]

https://app.bullpenre.com/profile/1742476177701x437444415125976000

https://author.billrapponline.com/

https://www.amazon.com/dp/B0F32Z5BH2

© 2023-2024 Bill Rapp, Broker Associate, eXp Commercial Viking Enterprise Team