🏦 SBA 504 vs 7(a): Which Loan Is Better for Business Owners? 💡

🏦 SBA 504 vs 7(a): Which Loan Is Better for Business Owners? 💡

💰 SBA 504 vs 7(a) Loans Explained – Best Financing for CRE Investors 🏢

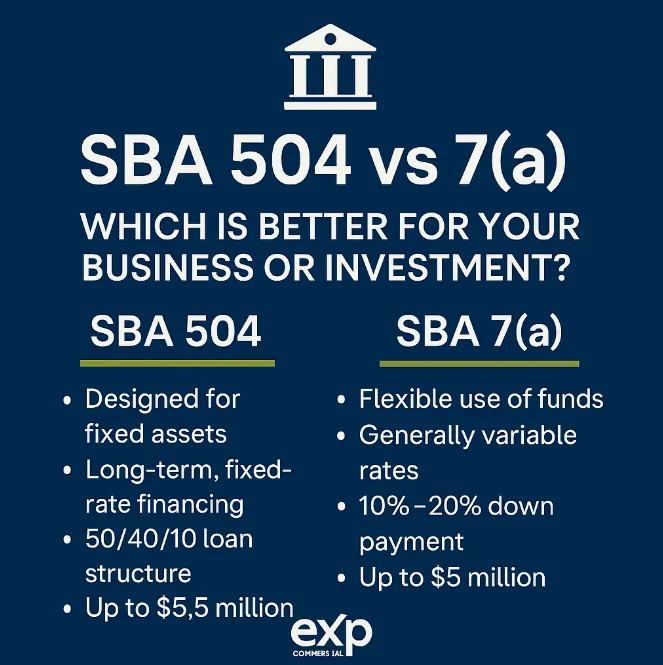

🏦 SBA 504 vs 7(a) – Which Is Better for Your Business or Investment?

When it comes to financing commercial real estate or business expansion, two SBA loan programs stand out: the SBA 504 loan and the SBA 7(a) loan. Both are backed by the Small Business Administration, but they serve different purposes and offer unique advantages depending on your goals.

🔑 Key Differences Between SBA 504 and 7(a) Loans

✅ SBA 504 Loan:

· Designed for fixed assets like commercial real estate, land, or equipment.

· Provides long-term, fixed-rate financing.

· Typical structure: 50% lender, 40% Certified Development Company (CDC), and 10% borrower down payment.

· Loan amounts can reach up to $5.5 million.

· Best for: business owners buying or building a facility.

✅ SBA 7(a) Loan:

· Flexible use: real estate, working capital, equipment, business acquisition, or debt refinancing.

· Generally offers variable rates tied to Prime.

· Requires 10%–20% down payment depending on use.

· Loan amounts up to $5 million.

· Best for: business acquisitions, renovations, or mixed-use projects.

📊 Pros and Cons

SBA 504 Pros:

· Low down payment (10%).

· Fixed-rate stability.

· Great for long-term CRE ownership.

SBA 504 Cons:

· Limited flexibility (mostly for real estate and equipment).

· Requires CDC approval.

SBA 7(a) Pros:

· Highly flexible use of funds.

· Faster approval timelines.

· Can combine multiple financing needs into one loan.

SBA 7(a) Cons:

· Often variable interest rates.

· Higher fees in some cases.

· Slightly higher down payment compared to 504.

🏢 Which Loan Is Better?

· Choose SBA 504 if: You’re acquiring or constructing commercial real estate you plan to own long-term.

· Choose SBA 7(a) if: You need broader flexibility—whether acquiring a business, funding working capital, or financing a property with value-add plans.

Both loans can be game-changers for business owners and CRE investors. The right choice depends on your goals, project type, and financial strategy.

👉 Next Step: Before making a decision, consult with a commercial mortgage broker who specializes in SBA financing to tailor a loan strategy that maximizes your return.

https://www.houstonrealestatebrokerage.com/

https://www.houstonrealestatebrokerage.com/houston-cre-navigator

https://www.commercialexchange.com/agent/653bf5593e3a3e1dcec275a6

http://expressoffers.com/[email protected]

https://app.bullpenre.com/profile/1742476177701x437444415125976000

https://author.billrapponline.com/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

© 2023-2024 Bill Rapp, Broker Associate, eXp Commercial Viking Enterprise Team