🧾 Triple Net (NNN) vs Gross Leases: What Every CRE Investor Must Know 💼

🧾 Triple Net (NNN) vs Gross Leases: What Every CRE Investor Must Know 💼

💡 NNN vs Gross Lease Explained: Pros, Cons & Which Is Right for You? 🏢

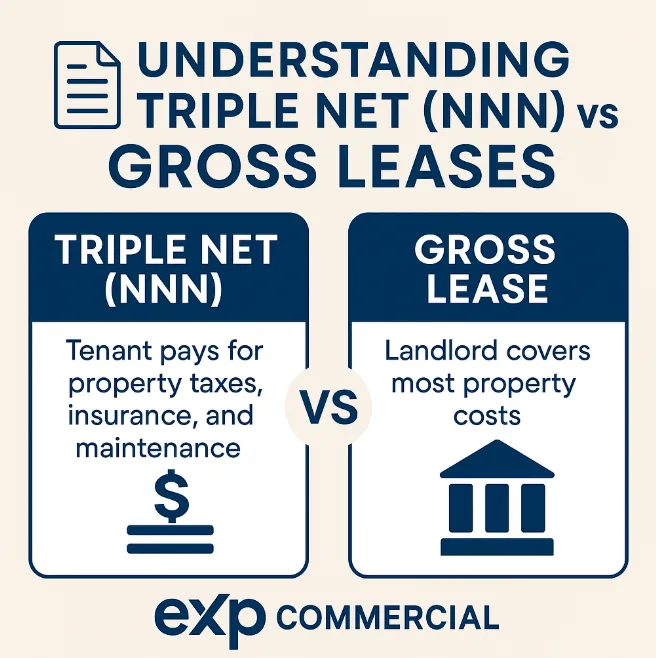

🧾 Understanding Triple Net (NNN) vs Gross Leases

When investing in commercial real estate, one of the most important decisions for property owners and tenants alike is understanding the type of lease agreement in place. Two of the most common structures are Triple Net (NNN) Leases and Gross Leases. Knowing the difference between these can significantly impact your cash flow, responsibilities, and long-term investment strategy.

🔹 What Is a Gross Lease?

In a Gross Lease, the tenant pays a fixed rent amount, and the landlord covers most or all operating expenses. This usually includes property taxes, insurance, maintenance, and sometimes utilities.

Key Benefits for Tenants:

· Predictable monthly rent with fewer hidden costs

· Simplicity in budgeting

Key Benefits for Landlords:

· Higher control over property management

· Ability to adjust rents to cover increasing expenses

Gross leases are commonly seen in office buildings and multi-tenant properties where expenses are easier to average across tenants.

🔹 What Is a Triple Net (NNN) Lease?

A Triple Net Lease shifts more responsibility to the tenant. In addition to base rent, tenants also pay for:

· Net Taxes (property taxes)

· Net Insurance (building insurance)

· Net Maintenance (repairs and upkeep)

This structure is popular in retail centers, medical buildings, and single-tenant properties.

Key Benefits for Tenants:

· Often lower base rent compared to gross leases

· Greater control over property maintenance and expenses

Key Benefits for Landlords:

· More predictable income with fewer operating expenses

· Reduced financial risk, since tenants cover property costs

🔹 Which Lease Structure Is Best?

The choice between NNN and Gross Leases depends on investment goals and tenant type:

· Investors seeking stable, low-management income often prefer NNN leases, especially with creditworthy tenants.

· Landlords with multi-tenant office buildings may lean toward gross leases for simplicity.

· Tenants looking for predictability often choose gross leases, while those seeking lower upfront rent may prefer NNN.

🔹 Final Thoughts

Both Triple Net (NNN) Leases and Gross Leases can be smart options depending on the property, tenant, and investor strategy. The key is to align the lease structure with your financial objectives, risk tolerance, and management style.

If you’re a commercial property owner, tenant, or investor in the Houston, Katy, or Fulshear market, our team at Viking Enterprise Team | eXp Commercial can help you evaluate lease structures and maximize your investment returns.

📞 Contact us today to explore your leasing and investment options.

https://www.houstonrealestatebrokerage.com/

https://www.houstonrealestatebrokerage.com/houston-cre-navigator

https://www.commercialexchange.com/agent/653bf5593e3a3e1dcec275a6

http://expressoffers.com/[email protected]

https://app.bullpenre.com/profile/1742476177701x437444415125976000

https://author.billrapponline.com/

https://www.amazon.com/dp/B0F32Z5BH2

https://veed.cello.so/FOmzTty6oi9

© 2023-2024 Bill Rapp, Broker Associate, eXp Commercial Viking Enterprise Team