📊 CAP Rate 101: Understand Capitalization Rates in CRE 📈

📊 CAP Rate 101: Understand Capitalization Rates in CRE 📈

🏢 What Is a CAP Rate in Commercial Real Estate? 🔍 Expert Guide 2025

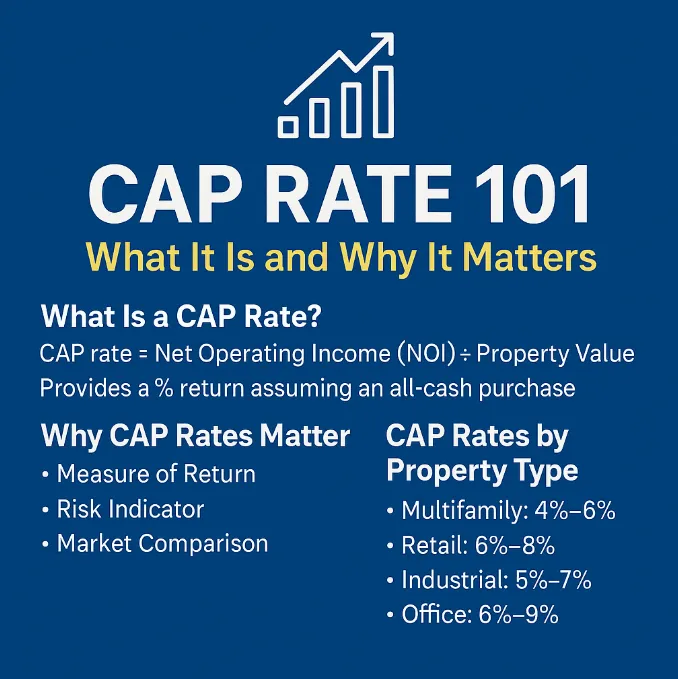

CAP Rate 101: What It Is and Why It Matters

Introduction

In the world of commercial real estate, few metrics carry as much weight as the capitalization rate, better known as the CAP rate. Whether you’re analyzing multifamily apartments, retail centers, or industrial warehouses, this figure helps investors quickly assess potential return and risk.

So what exactly is a CAP rate? And how should you use it in your investment strategy? Let’s break it down.

🔍 What Is a CAP Rate?

CAP rate = Net Operating Income (NOI) ÷ Property Value

It’s a simple formula that provides a percentage return on an investment property, assuming it's bought with all cash and no financing. For example, if a building generates $100,000 in annual NOI and is worth $1,000,000, the CAP rate is 10%.

💡 Why CAP Rates Matter

1. Measure of Return: CAP rates give you a quick look at how much income a property produces relative to its price.

2. Risk Indicator: Generally, higher CAP rates suggest more risk (but more reward), while lower CAP rates suggest safer, more stable investments.

3. Market Comparison: Investors use CAP rates to compare different asset classes and locations.

🏙️ CAP Rates by Property Type

· Multifamily: 4%–6% (often lower in high-demand areas)

· Retail: 6%–8%

· Industrial: 5%–7%

· Office: 6%–9%

Each sector comes with different risks—tenant stability, maintenance costs, and vacancy trends all affect what’s considered a “good” CAP rate.

📉 What Impacts a CAP Rate?

· Location: Urban areas usually have lower CAPs due to demand and appreciation.

· Tenant Profile: Credit tenants (like Starbucks or Amazon) push CAPs lower.

· Lease Terms: Longer leases with escalations are more attractive, often leading to lower CAPs.

· Property Age & Condition: Newer or well-renovated properties generally carry lower CAPs.

🤝 CAP Rates in Action: How Brokers Help

At Houston Real Estate Brokerage, we help clients interpret CAP rates in the context of local market trends, lending terms, and long-term strategy. Whether you’re buying a value-add deal or seeking a passive income asset, understanding CAP rates helps you make smarter, faster decisions.

📈 Final Thoughts

CAP rates are more than a quick math problem—they’re a window into an investment’s potential. But they aren’t everything. Always combine CAP rate analysis with property inspections, market research, lease reviews, and financing considerations.

Want help evaluating your next deal? Let’s talk.

https://www.houstonrealestatebrokerage.com/

https://www.houstonrealestatebrokerage.com/houston-cre-navigator

https://www.commercialexchange.com/agent/653bf5593e3a3e1dcec275a6

http://expressoffers.com/[email protected]

https://app.bullpenre.com/profile/1742476177701x437444415125976000

https://author.billrapponline.com/

https://www.amazon.com/dp/B0F32Z5BH2

© 2023-2024 Bill Rapp, Broker Associate, eXp Commercial Viking Enterprise Team